Bookkeeping

Break Even Point BEP Formula + Calculator

The following break-even point analysis formulas will help you get there. Let’s show a couple of examples of how to calculate the break-even point. Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website.

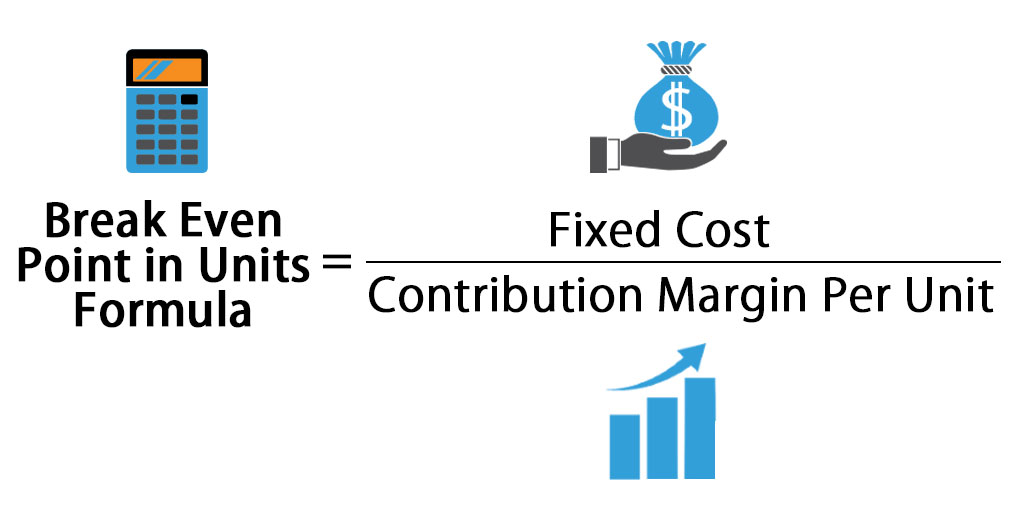

How to Calculate the Breakeven Point

We provide simple, predictable pricing to keep your break-even point analysis accurate and up to date. With monthly caps, flat pricing, and flexible solutions, you always know what you’ll pay. Once you reach this point, you’re usually ready to scale toward profitability—and that’s exciting. It’s the tipping point where you’re no longer losing money, but are not yet making a profit.

How to calculate your break-even point

- The breakeven point would equal the $10 premium plus the $100 strike price, or $110.

- Variable costs are the costs that are directly related to the level of production or number of units sold in the market.

- A more advanced break-even analysis calculator would subtract out non-cash expenses from the fixed costs to compute the break-even point cash flow level.

- If sales drop, then you may risk not selling enough to meet your breakeven point.

There is no net loss or gain at the break-even point (BEP), but the company is now operating at a profit from that point onward. If a business is at the precise break-even point, the business is neither running at a profit nor at a loss; it has simply broken even. Central to the break-even analysis is the concept of the break-even point (BEP).

Break-even analysis can be broken down into two parts:

Similarly, If a competitor starts offering big discounts, your projected sales might drop and may cause you to miss your break-even point. The sales price per unit minus variable cost per unit is also called careers at xero the contribution margin. Your contribution margin shows you how much take-home profit you make from a sale. Let’s take a look at a few of them as well as an example of how to calculate break-even point.

Break-even point formula example

For instance, if the company sells 5.5k products, its net profit is $5k. For example, if the economy is in a recession, your sales might drop. If sales drop, then you may risk not selling enough to meet your breakeven point.

For example, If your startup costs are $50,000 and your product sells for $50 with a $20 production cost, break-even analysis shows you’ll need to sell roughly 1,700 units to cover your expenses. From there, you can decide on pricing, production, and sales targets so your business can stay on the right track from the get-go. Simply enter your fixed and variable costs, the selling price per unit and the number of units expected to be sold.

If your business’s revenue is below the break-even point, you have a loss. This means Sam needs to sell just over 1800 cans of the new soda in a month, to reach the break-even point. Sales Price per Unit- This is how much a company is going to charge consumers for just one of the products that the calculation is being done for.

In other words, the no-profit-no-loss point is the break-even point. At the break-even point, the total cost and selling price are equal, and the firm neither gains nor losses. The Break-Even Point (BEP) is the inflection point at which the revenue output of a company is equal to its total costs and starts to generate a profit. Assume an investor pays a $4 premium for a Meta (formerly Facebook) put option with a $180 strike price. That allows the put buyer to sell 100 shares of Meta stock (META) at $180 per share until the option’s expiration date. The put position’s breakeven price is $180 minus the $4 premium, or $176.

If the stock is trading above that price, then the benefit of the option has not exceeded its cost. If the stock is trading at $190 per share, the call owner buys Apple at $170 and sells the securities at the $190 market price. The profit is $190 minus the $175 breakeven price, or $15 per share. By raising your sales price, you’re in turn raising the contribution price of each unit and lowering the number of units needed to break even. With less units to sell, you lower that financial risk and instantly boost your cash flow. The break-even point (BEP) is the point at which the costs of running your business equals the amount of revenue generated by your business in a specified period of time.

You’d need individual analyses for each product category to get a more accurate picture of your profitability. Note that the total fixed costs aren’t per product but rather the sum total of your business expenses over any given time period, whether that’s a month, quarter, or year (you choose!). When companies calculate the BEP, they identify the amount of sales required to cover all fixed costs before profit generation can begin. The break-even point formula can determine the BEP in product units or sales dollars. If the company can increase its contribution margin per unit to $8 (by perhaps lowering its per unit variable cost), it only needs to sell 8,750 ($70,000 / $8) to break even. Assume a company has $1 million in fixed costs and a gross margin of 37%.